Create a free account!

Network with other investors

Learn about real estate investing

Improve your chances of success

By signing up you agree to AZREIA's Terms of Service

Already have an account? Log in

27-Time National Award-Winning Premiere Real Estate Investors Association

Our Partners:

Discover Your Real Estate Investment Potential

Our Entrepreneurial Self Assessment is designed for you to understand if Real Estate Investing is right for you and, if so, are you best suited for active or passive investing. This Assessment is for anyone who wants to know if Real Estate Investing is right for them BEFORE spending time or money on education and training.

Build Your Investor-Friendly Real Estate Team

Connect with a network of trusted professionals in the real estate industry. From contractors to legal experts, our preferred vendors program ensures you have the right support for your investment journey. Each vendor has gone through a thorough evaluation process to ensure they are the best choices for you.

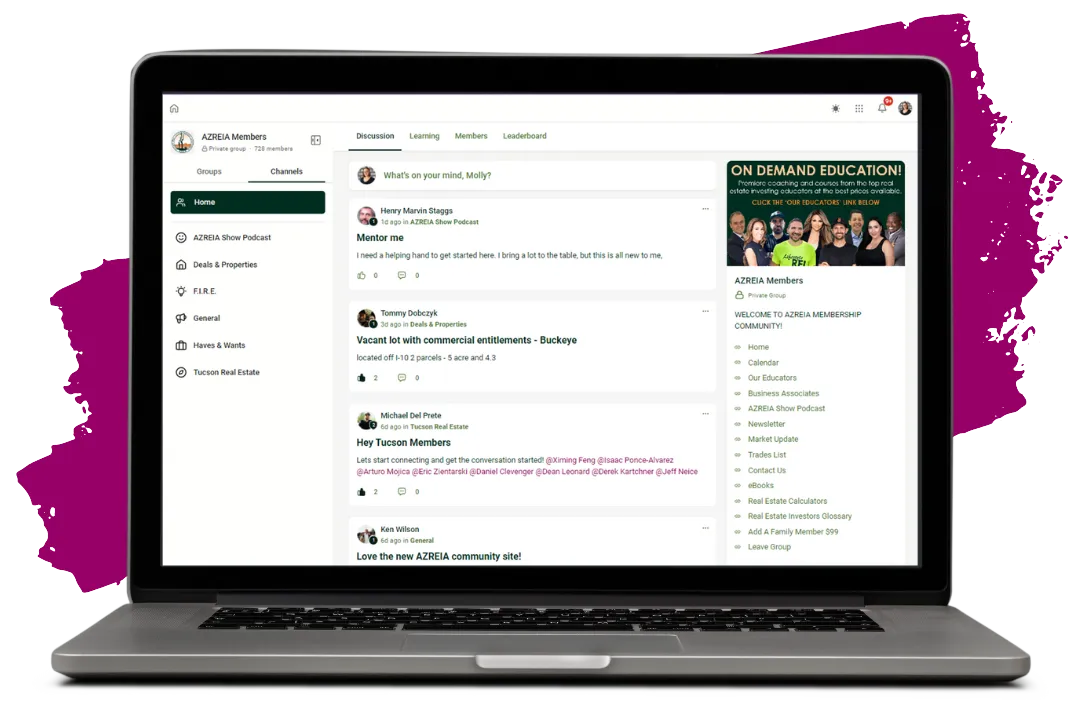

Engage & Network

Use the online community to get real estate advice from experienced investors, ask your local community for recommendations, hear diverse opinions on your investment decisions, and celebrate your wins together.

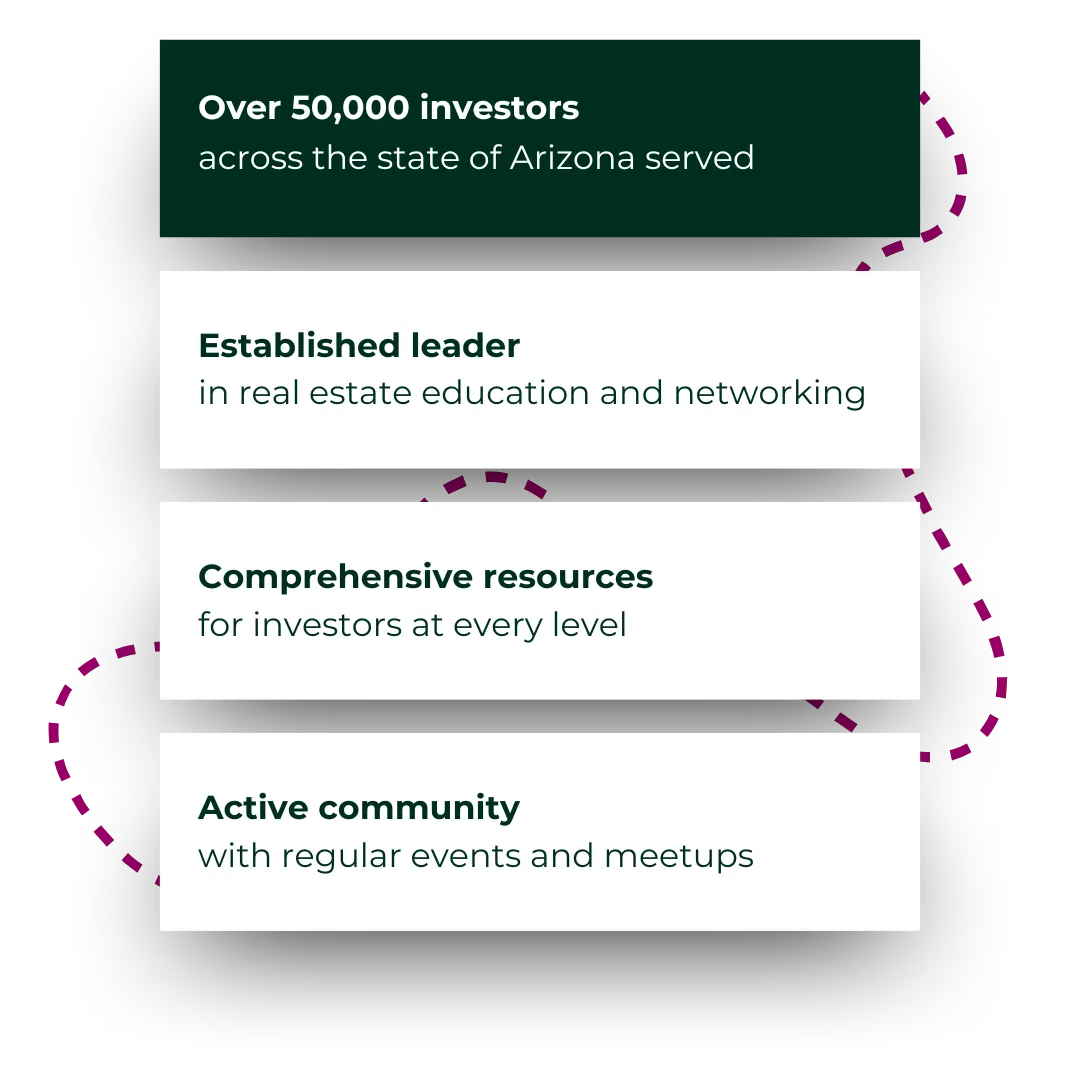

Who We Are

The mission of AZREIA is to provide its members the education, market information, support, and networking opportunities that will further the member’s ability to successfully invest in Real Estate. AZREIA has supported the needs of real estate investors since 2002, which makes us the longest-standing organization in the state dedicated to serving investors.

Hear From Our Members

Discover what investors like you are saying about AZREIA

Donna Londot

AZREIA is a wealth of information and they are so helpful when starting my investment portion of my real estate company. And it’s great to have someone right in your own state to talk to and run ideas or scenarios by, too. You gave me the expectations I should have with real estate investing. Thanks Mike and your team at AZREIA.

Jose Miller

I love AZREIA! For me, the subgroups are the best! It took me a while to settle on what part of real estate investing I wanted to be a part of and the subgroups allowed me to ask both beginner and very detailed questions to people that were happy to share their knowledge. I like how they've expanded to include more business partners, because I know that those partners are vetted and worry about their reputation inside of AZREIA.

Tony Simuel

I have been attending the AZREIA meetings for several months, it is amazing the amount of information you get from this organization. The networking alone is worth the membership because you will always find what you are looking for to make deals or to learn about how to make deals. Most importantly it gives you the courage to jump in the waters and play!

If you have any questions or are experiencing any issues with the website, don't hesitate to reach out to AZREIA customer support.

© 2002-2024 Arizona Real Estate Investors Association | All Rights Reserved