Latest Edition of

The AZREIA Advantage Digital Newsletter

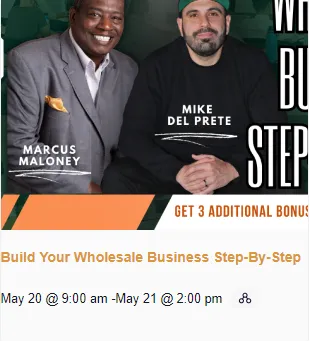

Cover Article | Mike Del Prete, AZREIA

What Is Real Estate Wholesaling and Why It Still Matters

Real estate wholesaling is an investment strategy where an individual called the wholesaler puts a property under contract at a discounted price and then assigns that contract to another buyer for a profit. The wholesaler doesn’t buy the property and they do not renovate it or manage tenants..Instead, they create value by identifying opportunities, negotiating effectively, and connecting motivated sellers with ready buyers.[READ MORE]

Executive Director Message

What This Market Really Rewarded This Year

Michael Del Prete | AZREIA Executive Director

As the year comes to a close, one fact stands out from hundreds of conversations with Arizona investors on The AZREIA Show, at our events, and one-on-one.

Real estate didn’t get easier this year. It got clearer. The market rewarded investors who did unglamorous work: slowing down, underwriting conservatively, focusing on fundamentals, and building real relationships. The winners were not the loudest voices on social media........[READ MORE]

Start. Stop. Continue.

Rob Jafek | Boomerang Capital Partners

As the year winds down, most of us feel the pull to pause for a moment and take stock. It is natural to look back at what worked and what did not, to look forward to where we want to go, and to try to draw a clean line between the two.The season lends itself to these reflections because there is something grounding about stepping out of the daily rush and asking a few simple questions. ....[READ MORE]

Do Your Business Entities and Investments Actually “Speak” to Your Estate Plan?

Michael J. " McGirr | Phocus Law

For most of my contributions to AZREIA, I focus on the nuts and bolts of dealmaking: contracts, LLC structures, lending terms, and all the fun (or sometimes not-so-fun) mechanics of real estate transactions. That’s where I spend the vast majority of my time. But one of the most important services we provide at Phocus Law sits on the personal side of your financial life - estate planning. And in the last couple of years, we’ve seen a huge increase .....[READ MORE]

Gila Insurance Group: Protect. Save. Serve.

Derek Kartchner | Gila Insurance

Real estate investing in Arizona is a high-stakes game of strategy and grit. Our market is wild—at times soaring, and at others, faltering. AZREIA gives you the tools to understand the market and the strategy to pursue; Gila Insurance Group protects you as you navigate your investor journey. Whether you are scaling a portfolio of single-family rentals or navigating your first fix-and-flip, the quality of your team determines your success. At Gila Insurance Group, we don’t just provide policies; we are active investors who understand the "Investor Life."....[READ MORE]

HUD’s FAIR HOUSING UPDATE AND CHANGES

Mark Zinman | Zona Law Group

The U.S. Department of Housing and Urban Development ("HUD") just announced significant changes to fair housing enforcement and compliance. We are here to break down the news, and how it affects owners and managers. We want to highlight some things about Arizona, in light of the federal changes. There are the main takeaways:...[READ MORE]

Invest Your Retirement Savings with Pride

J.P. Dahdah | VantageIRA

Investing is typically not an area most people are confident in. In fact, anything surrounding money and financial matters tend to make people uncomfortable, stressed, and anxious....[READ MORE]

Deconstruction vs. Demolition: 4 Primary Benefits

Chuck Warshaver | Stardust

When a business and/or homeowner decides to rebuild or remodel an existing structure, they want to finish the project as soon as possible and at the lowest cost. At first glance, it seems easier and quicker to demolish the building....[READ MORE]

Where the Smart Money Moves Next: A Clear Read on Today’s Market

Dan Noma Jr. | Easy Street Offers

After six months inching toward a buyer’s market, Phoenix has snapped back to balanced—not because demand spiked, but because over 40% of Q2 listings were canceled. When that much inventory is pulled from the MLS, supply appears tighter even as motivation among sellers quietly rises. Active listings are up double digits year over year, yet prices per square foot remain flat. Days on market have stretched toward 70, and price reductions are climbing....[READ MORE]

Expanding Single-Family Properties for Maximum ROI

Nicholas Tsontakis | Dwell Boldly

Often times, the best real estate strategy does not include finding another great deal, but looking at your existing inventory and realize it could be more. Maybe it’s a detached garage waiting to become an ADU. Maybe it’s a side yard wide enough for a new primary suite. Or maybe it’s an outdated floor plan yearning for open air and light. The potential is there and unlocking it takes imagination and preparation. Investors ready to expand single-family homes and small-scale....[READ MORE]

Legally Speaking Q&A: How Can I Avoid Fair Housing Violations When Screening Tenants

Mark Zinman | Zona Law Group

Question: I received a strange question from an applicant who has yet to pay his application fees. He emailed me and stated, "I just need to be assured the area around the home is an English-speaking community. I am personally sick of living in places that nobody speaks English. How is the area?” How do I respond to this? Do I ever have to answer this question?.....[READ MORE]

50-Year Mortgage: Why the Lower Payment Sounds Good but May Cost You More

Jason Powers | 1024Wealth

The idea of a 50‑year mortgage recently resurfaced in Washington corridors as a proposed solution to America’s housing‑affordability squeeze. The Trump administration and the Federal Housing Finance Agency (FHFA) floated it as a “game changer.” According to an Associated Press analysis in November 2025, on a median‑priced U.S. home ($415,200) with a 10 % down payment and a 6.17 % interest rate, a 30‑year mortgage would have a monthly payment of about.....[READ MORE]

Are Mineral Rights Considered Real Property?

Eckard Enterprises | Eckard Enterprises

Mineral rights ownership can be complex and require a certain amount of expertise to truly understand. Many accredited investors accustomed to traditional real estate want to know whether mineral rights are considered real property in the same sense that an apartment complex or office building would be. It’s a valid question, since mineral rights differ from traditional surface real estate in a lot of ways. However, mineral rights are legally classified as real property....[READ MORE]

Investor Market Update for AZREIA Members

Andrew Augustyniak | Neighborhood Loans

Market Update & Investor Opportunities: As we move toward the end of the year, I wanted to take a moment to update everyone on what we’re seeing in the market and, more importantly, how we’ve been helping investors continue to grow their portfolios despite ongoing uncertainty Expanding Opportunities Beyond Our Backyard One of the biggest themes we’ve seen recently is investors looking out of state for stronger cash flow, better short-term rental performance, and more favorable purchase prices....[READ MORE]

Investing in Real Estate With Your IRA: What Investors Need to Know

Nate Hare | Directed IRA

Many real estate investors focus on finding deals, raising capital, and managing cash flow, but overlook one of the most flexible tools available to them: their retirement account. Contrary to common belief, IRAs have always been permitted to invest in real estate. They can own rental properties, participate in private real estate partnerships, lend money as private lenders, or invest in commercial and multifamily projects. The limitation most investors encounter is not a legal one, but.....[READ MORE]

Investors and Wholesalers BEWARE! Real Estate Fraud is Always Lurking in Our Industry!

Maria Brandenburg & Janet Moe | Great American Title

The definition of Real estate fraud is using property transactions for financial deception, with common scams including wire fraud to intercept payments, fake listings, and impersonation of professionals like agents or lenders. Other forms include mortgage fraud, where false information is used to secure a loan, and title fraud, where ownership is fraudulently transferred. First-time homebuyers and renters are particularly vulnerable, making it crucial to verify.....[READ MORE]

PadSplit Market Update

Ellis Tran | PadSplit

Total Unit Count: 1282 (202 Properties)

Occupancy: 83% (87% Mature)

Weekly Rates: $212/week ($918/mo)

Days for First Booking in PadSplit: 6.1

Days to Reach 80% Occupancy: 33.1/49

If you have any questions or are experiencing any issues with the website, don't hesitate to reach out to AZREIA customer support.

© 2002-2026 Arizona Real Estate Investors Association | All Rights Reserved

Just Connect With us

AZREIA has monthly meetings in Phoenix, Tucson, Prescott, and Bisbee. The Phoenix meeting is held on the 2nd Monday of the month. These meetings are full of education, information, and networking.

Frequently Asked Question

What is Lorem Ipsum?

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

What is Lorem Ipsum?

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

What is Lorem Ipsum?

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

What is Lorem Ipsum?

Lorem Ipsum is simply dummy text of the printing and typesetting industry.